We're now downloading Dropbox. When your download is complete, run the Dropbox installer. Jan 15, 2021 The app started initially as a competitor to popular budgeting tools Mint and YouNeedABudget (YNAB). While budgeting is still the main feature, the Lunch Money has expanded beyond into other helpful features. In 2020 Lunch Money rolled out account-connecting support for cryptocurrency exchanges and wallets by partnering with Zabo. Jul 12, 2021 You Need a Budget (YNAB) The YNAB mobile app is available for both Android and iOS devices. We all know what is the most difficult part of budgeting – it’s being behind on your finances and spending this month’s income paying last month’s bills. Gain Total Control of Your Money. Stop living paycheck to paycheck, get out of debt, and save money faster with YNAB.

The latest version, dubbed 'The New YNAB' or 'nYNAB,' was launched December 30, 2015 as a web-based application, with apps for iPhone, iPad, and Android devices. The previous version 4, YNAB4, was released in June 2012. Version 4 was a desktop-based application available for Windows and Mac OS, with apps for iPhone and Android devices. Trusted Mac download YNAB 4.3. Virus-free and 100% clean download. Get YNAB alternative downloads. Download locations for YNAB for Mac 4.3.351, Downloads: 238, Size: 27.94 MB. Budget managing software.

Free download YNAB YNAB for Mac OS X. YNAB (You Need A Budget) is an easy-to-use budget software coupled with a powerful methodology.

Budgeting is a discipline that’s not often met with excitement. Many assume that budgeting is something reserved for companies or, say, freelance workers. However, personal budget software is just as important as corporate one — it’s a fundamental understanding of where money is coming and going.

Ynab 4 Mac Download Free

You may consider it to be boring, tiring, time-consuming, or difficult, but managing your finances well can help you achieve goals and stave off the stress of a rainy day. Thankfully, there are tools and apps on Mac which can help you get on top of budgeting, no matter how experienced you are.

Why Should I Use Budget Tracking Software?

If you haven’t done a budget before, you should start now. You never know when you might need a particular sum of money to solve an issue, meet a goal, or take advantage of a sudden opportunity.

Budget programs help you reduce the stress and uncertainty that comes with not knowing where you stand financially. If you don’t have a home budget software, you might be tracking towards a situation where you run out of money, without even knowing it. If you do have a budget, then you’ll have a documented plan of action to improve your situation.

Importantly, you don’t need any qualifications to do a budget, nor do you need to be good with numbers. Take advantage of the best budget software for Mac to help you take control of your finances without the hassle. Budgeting tools come in many shapes and sizes, so selecting the right one for you depends on personal preference and previous experience with managing money.

Handy tips for budgeting tools

If you’re ready to start your budget, it’s best to consider a strategic approach to ensure maximum utility. Too often, budgets sit collecting dust after being created, and sometimes the act of creating a budget could feel like enough to satisfy financial concerns — it’s not. Here are some tips for making the most out of your budget.

First of all, definitely use an app to help you manage a budget. App developers invest a lot of time and money into figuring out how their software can make your life easier and better, so rather than trying to understand all the nuances for yourself, let a dedicated app do it for you. There’s even some free budget software around, so you have very few excuses not to try!

If you run a business (or freelance on a side), a little bit of work each week means end of year taxes are a breeze. It’s not about doing a marathon of work in a few days, but making a habit to consistently do a little bit here and there. Try aiming for 10 minutes every few days. The best tax preparation software will also have reminders and notifications to help you achieve this goal.

It might sound contradictory, but budgeting isn’t always about getting the numbers 100% accurate. When it comes to tax preparation software — sure. But budgeting is mostly about understanding where your money is being spent and then using that information to make more informed decisions going forward. Therefore, make sure you categorize your transactions so that it’s easier to spot those minutiae differences and trends. The best finance apps should do this for you automatically.

In summary, you want to ensure you take advantage of the online budgeting tools available to you, aim to update your records frequently, and focus on categorization over accuracy.

Features of good personal budget software

The best personal budget software for Mac is easier to pin down when you know exactly what you’re looking for. Not all apps are the same — they vary by function and pricing. Generally speaking, there are a few key features you want to see in your budget software for Mac:

It should be simple and easy to add new records or transactions

Importing bank and credit card statements should be possible

Automatically synchronizing statements will take the edge off your manual inputting

Useful dashboards or visuals will help you understand your situation at a glance

You should be able to categorize your transactions into groups

Out of those five key points, the ability to import is often the most essential. Importing saves you the hassle of adding each transaction into the money management software line-by-line, which adds up to a lot of time. It’s hard enough already to schedule frequent updates to your budget, so if you can remove the largest friction point of manual entry, then you’re in a good place.

The best budget software for Mac comparison

When it comes to programs to help budget money, there are countless options. It’s easy to get lost diving deep into each budget software review, but here are some of the best available, ranging from beautifully basic to powerfully advanced.

You’ve probably heard of Quicken, given that the name has been around since the early 80s. Even then, it was known as one of the best tax software companies around. That says something about the strong product, which carries all of the basic functions you’ll need to manage your budget well.

Right away though, you might notice that the interface has become somewhat dated in comparison to the newer contenders out there. But one of Quicken’s praised features is the ability to download bank statements and have the records automatically categorized, which can drastically reduce the time it takes to input your information, so you can spend more time making sense of it. Sadly, the Mac version is somewhat limited when it comes to advanced features, unless you splash out for the Home and Business edition.

MoneyDance is very similar to Quicken in terms of its basic features, including the ability to create a budget with notifications for bills and invoices. It also allows you to make your own charts and graphs to monitor spending habits over time, which can be seen on the homepage for a quick glance of your activity. Out-of-the-box integrations with online banking services also make it easy to send payments.

Unlike Quicken, Moneydance has some more advanced features including an investment monitor, which tracks your investments and their fluctuations — a useful addition, although best for the intermediate to advanced user. The app also has a developer API system in place to allow extended functions, mostly good for power users. Importantly, security is not an issue, as Moneydance utilizes end-to-end encryption for your data to give you that extra peace of mind.

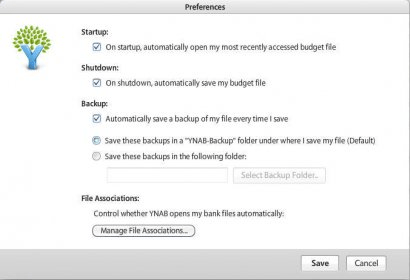

You Need A Budget, also known as YNAB, is budget tracking software that runs on both Windows and Mac via web — saving automatically to the cloud, which is a bonus for multi-platform users. It also features native apps for iOS and Android, so you can literally tackle your budget from anywhere.

The app itself follows a simple design language, which is perfect for beginners, but if you find yourself needing help you can sign up for a personal instructor. YNAB doesn’t let you slack at all, and if you start to stray from your budget, the app will raise a red flag through it’s built-in Accountability Partner.

Although YNAB doesn’t support the ability to download and automatically categorize records from bank statements, it could be argued that entering them manually helps the user pay more attention to where their spending is going. Still, it’s a more time-consuming process that might be problematic for users processing hundreds or more records each month.

Ynab 4 Mac Download Full

MoneyWiz stays true to its name — a comprehensive budget software and investment tracker that’s packed full with over 400 useful features. View your financial situation quickly by browsing accounts, groups, or searching for individual records. Speaking of records, you can enter them manually or have them automatically sync with leading banks, cryptocurrency exchanges, and financial services for an accurate real-time understanding of your accounts.

With all of this data in hand, MoneyWiz can prepare and export over 50 reports to help you gain deeper insights into your finances. Your data could be accessed from its cloud-based app or straight from the native software for Mac. All in all, MoneyWiz is extremely powerful: accessible for beginners and interesting for the most advanced users.

Receipts is yet another money management software for Mac, and is specifically well-known for its clever handling of invoicing. Using Optical Character Recognition (OCR) technology, Receipts automatically reads and translates important information about your bills, such as amount, date, currency, and more (even if the text is in another language).

Besides, Receipts can issue payments for invoices directly using third-party providers, such as iFinance and BankX. The OCR technology alone makes it a strong contender against other more simple online budgeting tools. Not least, Mac users will be glad to see how this application was designed to look and feel like a macOS product. Using a familiar user interface could make life a little easier after all.

Between the five options above, you have a strong starting point for your budgeting tools depending on your experience. Remember that importing is one of the key features to look for in budget programs. Still, in order to find the best fit you might need to try a couple of different options.

Thankfully, both MoneyWiz and Receipts have a free 7-day trial that you can take advantage of by heading over to Setapp, an app subscription service for Mac that gives you access to over 150 macOS apps, including all the necessary budget tools. Getting MoneyWiz and Receipts at once? You won’t be disappointed.

Ynab Log In

Ynab 4 Classic Download

Meantime, prepare for all the awesome things you can do with Setapp.

Read onSign Up

Ynab Free Version

I’ve been using You Need a Budget (YNAB) for over a year and I’ve been very happy with it. The YNAB implementation is unique in the finance management software market but it’s based on a simple model called “envelope budgeting.” YNAB preaches “give every dollar a job” and the desktop app does a good job encouraging proper budgeting. I’ve discussed this at length on Nerds on Draft episode 19.

This week they released YNAB 5 and it’s clearly not aimed at me. YNAB has replaced their desktop application with a Mint-like cloud service and in doing so undermined the very reason I felt secure with their software. All previous versions of YNAB gave me sole control over the software. I could sync through Dropbox but I was also in control of that decision. All data stayed on my laptop and I was not required to share it with anyone.

YNAB 5 is a completely hosted solution, with a future desktop application to interact with the service. For some, the convenience may be worth the risk. I left Mint because I didn’t want to share my data, no matter how buzz-full their security policy sounded. I’ve reviewed all of the publicly available information about YNAB 5 and I see no 2-Factor Authentication.1 I see no information about employee access standards. I see no information about master key controls. With YNAB 5, I see no end-user benefit for the added vulnerability.2

Now, I know some people will ask “what’s the big deal?” Not syncing all of my fully annotated financial data, aspirational projects, family burdens, and poor life choices was one of the best features of YNAB 4. Not even my accountant gets as much information as I put into my finance software. I try hard to avoid single points of compromise and I’d certainly not choose a brand new cloud service to hold my entire identity.

The YNAB security page is moderately informative but doesn’t really provide the detail I’d want when handing over all of my financial information and account logins. They state that data at rest is encrypted. However, as we learned from Ashley Maddison, it doesn’t much matter if the master keys are also stored in the same environment.

They are using one of the standard providers for banking API access, Finicity. For that matter, Finicity offers their own similar service called Mvelopes. So if you implicitly trust Finicity (and think a modern Web site should be Flash-based), there’s another option.

It’s a highly competitive market out there for hosted finance tracking services. If that was what I was in the market for, I’d have plenty of options. But I’m not so I don’t. Here’s what I’ve tried in the very brief time since the YNAB 5 announcement. These are not complete reviews. I’d need at least 6 months to do a complete review.

iBank

iBank is probably the most feature complete stand-alone application. They offer plenty of online subscription options to make account syncing easier, but that’s not what I want.

iBank has a robust import and transaction categorization option, direct account syncing for many banks, and integration with Reminders for Mac. I also really liked the way the envelope budgeting is represented as a comparison with typical retrospective budgeting.

Feature complete can also be a euphemism for “a lot of damn controls.” iBank is not an enjoyable app to use. The envelope budgeting is too opaque and awkward. It feels like it was bolted on to something designed as a traditional retrospective budgeting application. The reporting options are sparse and slow.

MoneyWell

This application would be perfect if it worked. The envelope budgeting is very similar to the YNAB system. It’s easy to use but lacks some of the nice YNAB 4 reports.3 Unfortunately, I’ve been unable to get the envelope budgeting to work and there’s been no response from their support email or forum. Given that the first of the year is a key time for budgeting that’s a little surprising.

Moneydance

What a pretty application (minus a few visual glitches). The interface is just lovely. It’s also open enough to allow third party plugins, provide password protected Dropbox syncing and has a ton of reports. It’s also available for multiple platforms and has a direct purchase option.

I like the reporting options but most of them are just text. That’s not bad but set your expectations correctly.

The envelope budgeting option is functional but still feels a bit awkward. What I do like is that I can create separate budgets which allowed me to compare budget plans. The monthly rollover option is similar to YNAB. Support for both categories and tags makes it great at evaluating where we are doing well and where we are falling down on our plans.

While Moneydance does have direct download options for bank transactions, it failed to connect for several of my banks. But it failed as often as any other application I’ve tried. When it does work, it’s a smooth process and a super time saver.

The biggest issue with Moneydance is the occasional bugs. Updating budget amounts have occasionally changed the entry without notice. It can be a little awkward to navigate but otherwise has all of the features I want.

MoneyWiz

This is the most Mac-like app of the bunch. It’s simple and colorful.

Unfortunately, many of my ATM withdrawals were imported as income instead of expense. While I appreciate the wishful thinking, that created a lot of extra work. The import wizard is quite nice and managed to match existing categories and payees accurately. However, if you want to edit those after an import it’s very tedious and requires a pop-over and tab change.

Current State

I’m still using YNAB 4. It’s supported for bug fixes until 2017. But, I’ve begun transferring everything over to Moneydance which has proven itself as an easy to use and flexible budgeting system. Who knows, maybe it will even be better than YNAB 4 now that I’ve been forced to give it more time.

As someone that has recommended YNAB wholeheartedly to my friends, I’m disappointed. It’s turned a corner looking for subscription customers and I’m just not interested in following. I spend a lot of money on software (like in this post) and a lot more on privacy. It’s too bad that model wasn’t enough.

They’ve mentioned in the forums that 2FA may be coming in the future. YNAB 5 feels a lot more like beta software than I’m comfortable using for my financial data. ↩︎

Jeff and I also discussed this at length on the latest Nerds on Draft. ↩︎

Arabian love poems nizar qabbani pdf. Then again, so does YNAB 5. ↩︎